Comparison between bilateral loans and syndicated loans. Available at: https://www.finleycms.com/blog/whatare-syndicated-loans

Description

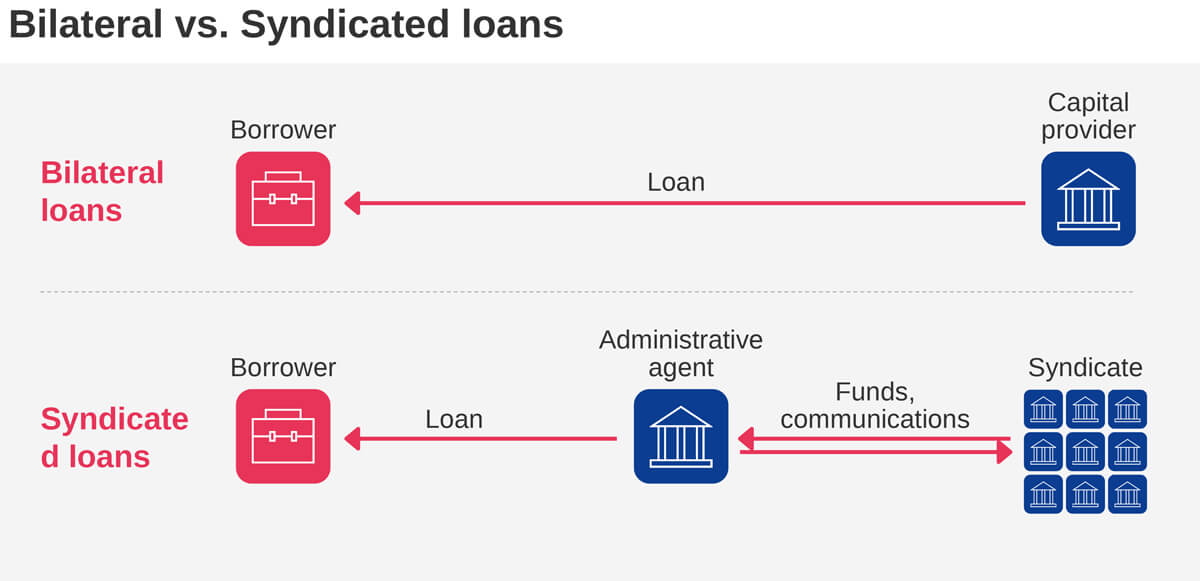

A syndicated loan is a financial arrangement in which a large loan is provided by a group of lenders, known as the syndicate, to a single borrower, typically a corporation or a government entity. This form of financing allows for the pooling of resources from multiple financial institutions to fund a borrower’s capital needs and are commonplace for large-scale infrastructure projects.

Syndicated loans offer several advantages to borrowers and lenders. For borrowers, the syndication allows for a larger pool of capital than what might be available from a single lender. For lenders, the risk is distributed among multiple lenders, reducing the exposure for each individual institution. Participation in a syndicated loan also allows institutions to diversify their portfolios without necessarily taking on too much risk associated with a large loan.

The structure of a syndicated loan is typically such that there is a lead bank or underwriter. The lead bank usually lends a larger proportion of money or takes up administrative duties. The terms of syndicated loans include interest rates, repayment schedules, and covenants, taking into consideration lenders’ interests and size of participation. Syndicated loans can be structured as term loans with fixed repayment schedules or as revolving credit facilities with flexible borrowing limits.

Enabling Conditions and Key Considerations

- Creditworthiness of the city or project. The credit rating of a project or a city significantly shapes the terms and conditions it can secure in a loan. Cities or projects with strong creditworthiness often qualify for more favourable interest rates and repayment terms. The assessment of a project or a city’s creditworthiness depends on its financial statements, including income statements, balance sheet statements, and cash flow statements. In assessing financial health, banks will seek indicators such as a stable revenue stream, manageable debt levels, and positive cash flows.

- Legal framework to enforce loan terms. Banks require assurance that borrowers will adhere to all legal and regulatory requirements in securing a term loan. This assurance spans from understanding the city’s or project team’s authority to borrow and raise debt, verifying the legality of the intended use of funds, and ensuring the bank’s ability to enforce repayment terms. A stable regulatory environment provides a foundation for the successful execution and enforcement of term loans.

Potential Challenges

- Structuring the loan can be complex and time-consuming. As the loan involves multiple lenders, negotiating terms and conditions can be a complex and time-consuming process, potentially delaying project progress. In addition, as a syndicated loan involves multiple parties, it is important for the primary and syndicated loan documents to clearly define the roles of each party and set forth their relative rights, obligations and priorities amongst the other parties. This increases the duration of the loan negotiation process, and amount of administrative work required.

- May not be suited for financing unproven or early-stage smart-city projects with limited financial track records. Early-stage smart-city projects with limited cash flows may find it challenging to prove their creditworthiness to banks and other lenders in the syndicate. Making it slightly more challenging for early-stage projects with no cash-flow to take loans.

- Cities or projects might face challenges in securing favourable rates. Cities with lower credit rating or a history of financial instability may face challenges in securing favourable borrowing terms. Limited creditworthiness can result in higher interest rates, stringent repayment conditions, or even difficulties in obtaining the loan. Improving the city or project creditworthiness through sound financial management practices becomes crucial in overcoming this challenge.

Potential Benefits

- Access to significant sums of capital. Syndicated loans enable borrowers, such as municipalities or corporations involved in smart city projects, to access significant amounts of capital that might be challenging for a single lender to provide. This is crucial for financing large-scale infrastructure or technology initiatives that are typical of smart city developments.

- Risk sharing among lenders. By distributing the loan amount among multiple financial institutions, syndicated loans spread the risk associated with large loans. This risk-sharing is particularly appealing in the context of smart city projects, which can be complex and carry higher levels of uncertainty and risk.

- Simplified loan management for borrowers. For borrowers, managing a syndicated loan can be more straightforward than juggling multiple separate loans from different lenders. With a syndicated loan, there’s typically a lead institution that acts as the point of contact for the borrower, streamlining communication and administrative processes.

Sources

- Investopedia (2024). Syndicated loans: what it is, how it works, and examples. Available at: https://www.investopedia.com/terms/s/syndicatedloan.asp

- Corporate Finance Institute. Syndicated Loan. Available at: https://corporatefinanceinstitute.com/resources/commercial-lending/syndicated-loan/

- Dentons (2014). Special Problems of Syndicated Loans. Available at: https://www.dentons.com/en/insights/articles/2014/april/14/special-problems-of-syndicated-loans

- BDC. Syndicated Loan. Available at: https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/syndicated-loan