Description

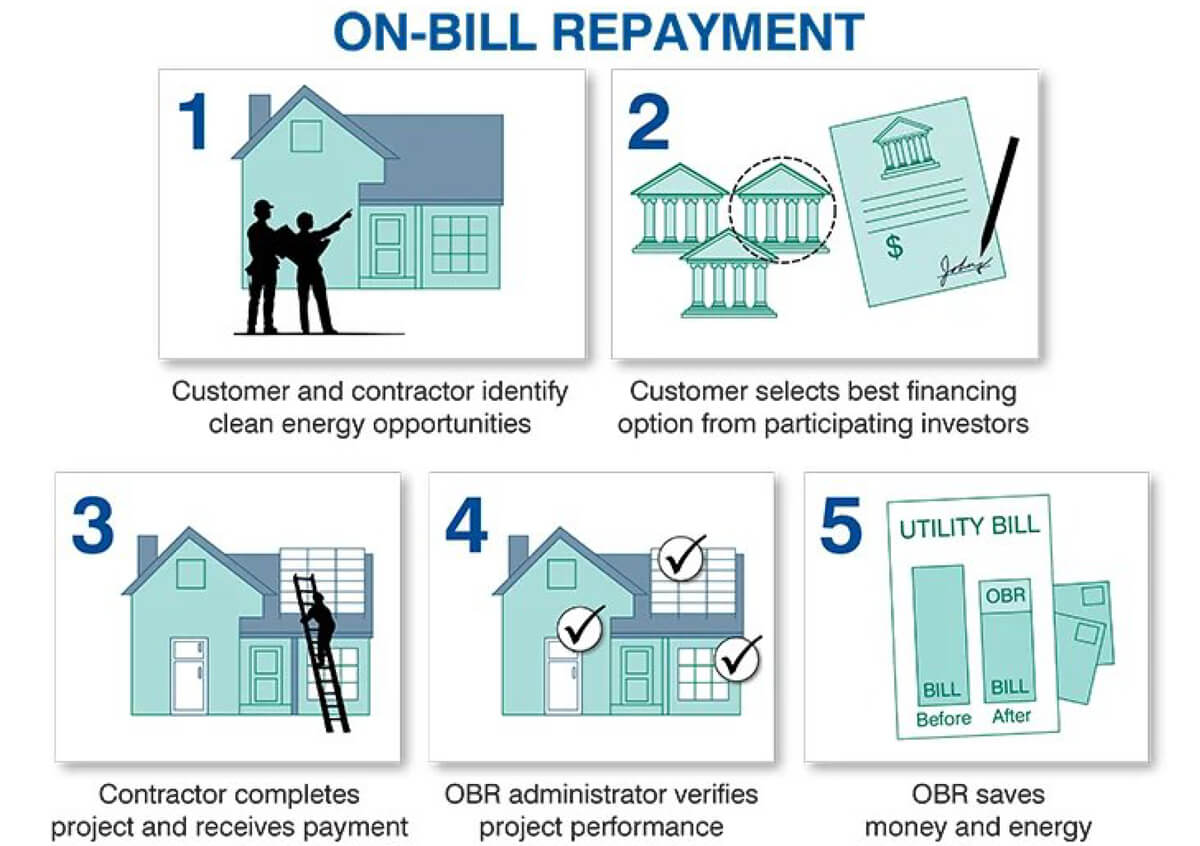

On-bill financing (OBF) or on-bill repayment (OBR) schemes allow end-users (businesses and households) to finance small scale energy efficient projects by integrating the cost into their monthly utility bill. Under this arrangement, customers can acquire energy efficient equipment without upfront expenses and the cost is repaid over time. The utilities or a third-party lender, such as a financial institution or energy equipment company, covers the capital cost for the upgrade. The customer repays this cost through their monthly utility bill.

The repayment structure can take various forms, including i) as a tariff-on-bill, where the utilities covers the energy efficiency measure’s cost, and the end-user pays an additional tariff on the bill for this service; ii) as an on-bill loan scheme, where the loan is repaid on the end-user’s monthly bill; or iii) as a line-item billing, where the utility bill serves as a tool for the end-user to make repayments to the third-party lender.

In some cases, on-bill schemes are structured to allow for ‘bill neutrality’. This means that the projected energy savings resulting from the upgrade are sufficient to offset the monthly loan repayment or tariff installment. Consequently, the end-user does not experience higher utility bills than before the intervention. Once the payback period is reached, the end-user can realise real on-bill financial savings from the energy efficiency upgrade.

Description of on-bill repayment process. Available at: https://blogs.edf.org/energyexchange/2014/03/05/hawaii-taps-on-bill-repayment-program-for-cleanenergy-financing-and-job-creation/

Enabling Conditions and Key Considerations

- Ability to collect monthly utility fees. The utilities developer or provider needs to be able to collect monthly utility bills for on-bill schemes as these payments are an integral part of the scheme’s success. On-bill schemes capitalise on established billing processes to finance energy efficiency projects and minimises the need to create separate payment structures, and the flow of the repaid funds would need to be clearly established.

- Clear regulatory framework. Clear guidelines on how utility companies can recover costs, set tariffs, and collaborate with third-party lenders are essential for establishing the legal and procedural framework governing on-bill schemes. Additionally, regulations pertaining to consumer lending and their potential implications for structuring on-bill programs will also need to be considered.

- Access to dispute resolution mechanism. Disputes may arise due to various reasons, such as disagreements over billing, perceived discrepancies in energy savings, or issues related to equipment performance. Establishing clear guidelines and protocols to address such situations effectively is important for the success of on-bill schemes. Dispute resolution mechanisms should be accessible to consumers, ensuring they are able to receive appropriate and timely assistance.

Potential Challenges

- Lack of familiarity with OBF schemes amongst industry players. Utilities providers tend to have little experience with project financing and therefore may struggle to administer OBF programs. Utilities providers may also need to overcome the perception that they must function as a financial institution to participate in on-bill schemes, including handling non-repayments, finding capital, and addressing non-utility fuels. These challenges could impact participation in OBF schemes.

- Legal and regulatory challenges. Navigating existing regulations on utility providers and consumer lending can pose as challenges for utility providers and lenders to implement on-bill schemes, and potentially affect the practicality of these programs.

- Lack of awareness amongst consumers. Raising awareness among end users is crucial to garner support and foster the adoption of on-bill schemes. Many consumers may not be familiar with the benefits or mechanisms of OBF, and therefore a comprehensive awareness campaign is essential for its success. Informing users on the advantages, cost-saving potential, and availability of on-bills schemes can help consumers make more informed decisions to participate in energy efficiency projects, build trust and confidence in such schemes, and ultimately promote more sustainable energy consumption practices.

Potential Benefits

- Leverage existing client base for funding. OBF schemes allows utilities providers to leverage their existing relationship with customers (i.e., businesses and households) to provide alternative financing options for energy efficiency investments, unlocking an alternative channel for funding such projects.

- Flexibility in financing projects in underserved markets. There are various models to structure OBF schemes to support energy efficiency investments. For example, customers can repay part or all of the cost of the energy efficiency improvement using money saved on their utility bills. This flexibility means that OBF schemes could help traditionally credit-constrained markets gain access to project financing.

Sources/Additional Information

- Renonbill (2020). Overview of on-bill building energy renovation schemes. Available at: https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5caeffd7a&appId=PPGMS

- BASE (2020). Knowledge brief series green on-bill financing. Available at: https://energy-base.org/wp-content/uploads/2020/03/Knowledge-Brief-Green-On-Bill.pdf

- Center for Climate and Energy Solutions (2013). On-bill financing. Encouraging energy efficiency. Available at: https://www.c2es.org/wp-content/uploads/2013/08/on-bill-financing.pdf

- American Council for an Energy-Efficiency Economy (2011). On-bill financing for energy efficiency improvements: A review of current program challenges, opportunities, and best practices. Available at: https://www.aceee.org/sites/default/files/publications/researchreports/e118.pdf

- Asian Development Bank (2023). Financing climate-friendly cooling at city-scale. Available at: https://www.adb.org/sites/default/files/publication/872166/eawp-061-climate-friendly-cooling-city-scale.pdf