Different types of GSSS bonds. Available at: https://www.fidelity.com.sg/beginners/esginvesting/finding-the-right-tree-in-a-forest

Description

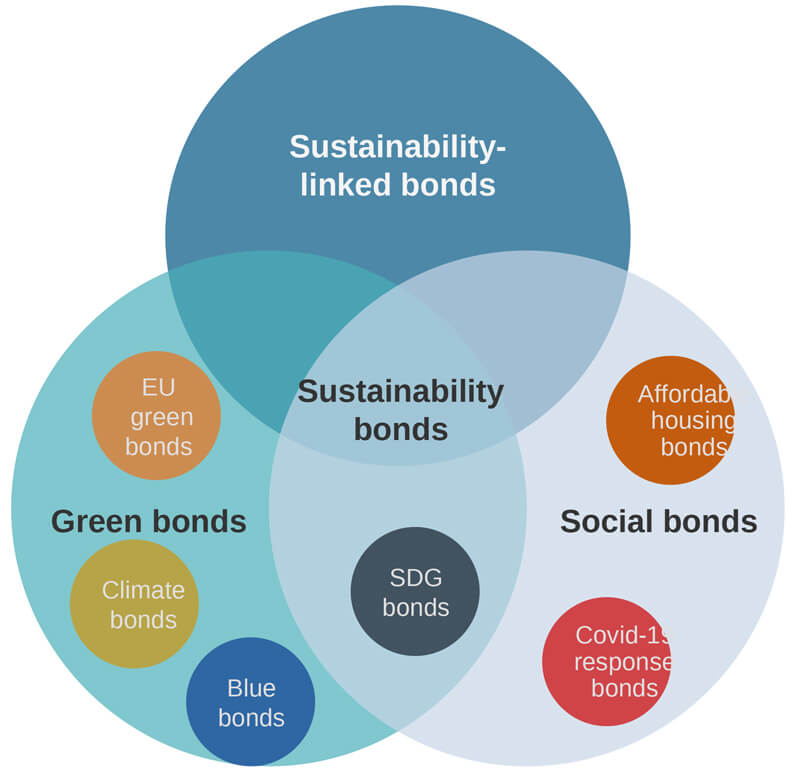

Green, social, sustainable, sustainability-linked bonds (GSSS bonds) direct proceeds raised to initiatives fostering positive environmental, social, and sustainable outcomes. Many ASEAN countries have issued GSSS bonds, with the support of national governments and multilateral development banks.

Enabling Conditions and Key Considerations

- Adherence to international principles and standards. Bonds issued for green, social, or sustainability-linked initiatives should adhere to international standards or principles, such as those set out in ASEAN’s GSSS bond standards, which is based on the International Capital Market Association (ICMA)’s GSSS principles. Doing so can help enhance investor confidence and prevent greenwashing, reduce transactions costs, and foster efficient trading and even improve liquidity of the market.

- Establish national guidelines or frameworks on GSSS bond issuance. Having a national framework or set of guidelines on GSSS bonds can play a crucial role in encouraging local governments to view them as a viable option for financing smart city projects. These guidelines not only help facilitate the issuance process and prevent greenwashing but also send strong signals of government support for sustainable investments.

- Use of risk-mitigation strategies. A common challenge faced by GSSS bonds is the lack of investment grade ratings from major credit rating agencies, in turn affecting investor interests. To this end, the use of credit-enhancing mechanisms, such as guarantees, can significantly elevate the bond’s rating, and enhance investor appeal. Another potential strategy involves leveraging quasi-government institutions, such as local state-owned banks, national pension funds or state insurance providers for initial sales, to build market confidence in the instrument and lay the foundation for broader institutional investor trust.

Potential Challenges

- Lack of enabling regulatory framework. A lack of internal government resources and guidance allocated to developing standardised guidelines and an enabling regulatory environment can impede the issuance of GSSS bonds and result in a dearth of such instruments available in the domestic capital market. Unclear legal frameworks can also deter cities from bond issuance.

- Limited experience issuing GSSS bonds. Local governments may have limited experience in issuing a GSSS bond. Issuers need to contend with specific industry standards, assessment metrics, and monitoring and verification process, making the overall process complex and demanding. A lack of clear national guidelines would further compound this challenge and deter local governments from viewing GSSS bonds as a viable financing option for smart city projects. In addition, local governments that have poor financial management capacity or track record for operating within budget may be constrained in accessing GSSS bond markets through their own issuance ability.

- Cost of meeting GSSS bond certification or disclosure requirements. Attaining the “green bond” label, monitoring and managing disclosure requirements are typically performed by a third-party, which in some markets, can be a relatively high cost (ranging from USD 10,000-100,000) and could pose a barrier for some issuers.

- Limited understanding and interest from domestic investors. Limited interest from domestic investors can hinder the use of GSSS bonds to fund smart city projects and impede the growth of the local GSSS bond market. The lack of understanding on GSSS bonds’ benefits, the perception that the issuance of thematic bonds is more complex than conventional bonds without substantial added benefits, the lack of disclosure requirements for investors to reveal the environmental impact of their holdings, and even a lack of credit enhancement options to make bonds more attractive to investors, are factors that can contribute to a lack of interest from investors.

Potential Benefits

- Funding for green, social, sustainable projects. GSSS bonds provide cities with a dedicated alternative source of funding for environmentally friendly and socially responsible projects. By accessing capital through these bonds, cities can advance their sustainability goals without solely relying on traditional financing methods like bank loans.

- Long-term financing option. GSSS bonds can provide long term financing, as the timing of green infrastructure projects’ cash flow are generally compatible with medium- and long-term bond repayment schedules.

- Aggregator for smaller GSSS projects. Bonds can be used as an effective strategy for financing smaller, green, social or sustainable projects by aggregating them under a single bond issuance. This approach could allow municipalities to overcome individual project size limitations and achieve economies of scale for transaction costs.

- Enhance reputation and credibility. Aligning city-based projects with GSSS bonds frameworks can help ensure urban infrastructure follow national or international green, social, or sustainable standards or frameworks. Linking smart city projects to bonds can also help build transparency and internal administration procedures that can lead to sound financial management for the city. This commitment can enhance the city’s reputation and credibility among investors, residents, and other stakeholders, and foster a positive image, potentially attracting further funding for future projects.

Sources/Additional Information

- Climate Bonds Initiative (2022). ASEAN Sustainable Finance State of Market 2022. Available here: https://www.climatebonds.net/files/reports/cbi_asean_sotm2022_final.pdf

- OECD (2021). Scaling up Green, Social, Sustainability and Sustainability-linked Bond Issuances in Developing Countries. Available here: https://one.oecd.org/document/DCD(2021)20/En/pdf

- OECD (2016). Green bonds. country experience, barriers, and options. Available here: https://www.cbd.int/financial/greenbonds/oecd-greenbondscountries2016.pdf

- Matheson (n.d.). ESG: Green Bond Principles updated. Available here: https://www.matheson.com/insights/detail/esg-green-bond-principles-updated

- Climate Policy Initiative (2016). Green Bonds for Cities: A Strategic Guide for City-level Policymakers in Developing Countries. Available at: https://www.climatepolicyinitiative.org/wp-content/uploads/2016/12/Green-Bonds-for-Cities-A-Strategic-Guide-for-City-level-Policymakers-in-Developing-Countries.pdf