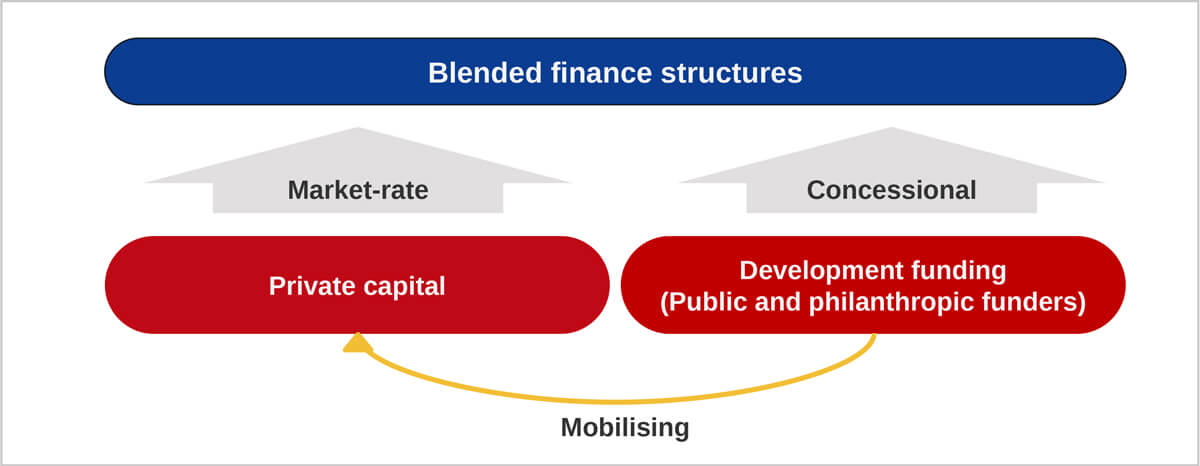

Structure of a blended finance vehicle.Content adapted from: https://www.convergence.finance/blended-finance

Description

Blended finance is a structuring approach that leverage funds or credit enhancements from public and/or philanthropic sources to make investments more attractive for private investors. In blended finance structures, public grants or private philanthropic funds can be executed as concessional loans, bond guarantees or technical assistance amongst other instruments, to bridge funding shortfalls and make projects more feasible or attractive for private sector participation. Blended finance structures can take various forms but what is critical is the use of catalytic funding from public and/or philanthropic parties to improves the risk/return profile of the transaction or project in order to attract participation from the private sector. Different investors in a blended finance structure will have different return expectations, ranging from concessional to market-rate. The intended outcome is the development of a robust market environment conducive to sustainable investment, fostering long-term economic growth and positive social and environmental impact.

Enabling Conditions and Key Considerations

- Market conditions for commercial finance. The existing market conditions play a crucial role in shaping the potential to attract commercial finance within a blended finance structure. A market with well-established regulatory frameworks, geopolitical and financial stability, is inherently more conducive to drawing in commercial finance, leading to increased mobilisation.

- Minimised, targeted, and temporary concessions. A key element of blended finance structures involves employing concessional finance (e.g. concessional loans, guarantees, etc.) to address market failures and mobilise commercial finance. These concessions need to be minimised, well-targeted, and temporary to avoid the risk of using public funds to over-subsidise risks to the private sector that will continue to persist in the absence of adequate market development.

- Commercial sustainability of a project. Blended finance can help overcome market failures and mobilise commercial finance that otherwise would not be forthcoming. However, it is imperative that blended finance is not deployed in or projects where commercial sustainability is unlikely to be achieved. Doing so could result in locking in subsidies for transactions that are financially unsustainable.

- Accompanying interventions for market development. Ensuring commercial sustainability of a project may necessitate interventions aimed at fostering market development that extend beyond the individual blended finance transaction. These accompanying interventions could include policy reforms, technical assistance, capacity building programs, and monitoring to assess progress. Such programs could, for example, focus on fostering a collaborative financing culture and mindset among municipalities and the private sector to enhance adoption of alternative financing options for smart city projects. Alignment among city officials, donor agencies, and other stakeholders is crucial in determining and implementing these interventions.

Potential Challenges

- Complexity in structuring a blended finance vehicle. Structuring a blended finance vehicle is inherently complex. It involves coordinating with various stakeholders with varying interests across extended delivery chains. The process requires careful consideration on the amount of concession provided, striking a balance between providing sufficient concession to attract commercial investment yet not excessively high to risk over-subsidising their involvement. The bespoke nature of each project adds an additional layer of complexity, necessitating tailored solutions to accommodate unique objectives and contexts of the project. This is particularly challenging when government officials lack experience in structuring blended finance vehicles.

- Challenges in aligning stakeholder expectations. Aligning expectations across diverse stakeholders within a blended finance structure presents a significant challenge. Each stakeholder, including public institutions, private investors, and donor agencies, may have distinct objectives, risk levels, and timelines, making it challenging to harmonise expectations. This challenge underscores the importance of having robust and transparent communication to foster a cohesive blended finance approach.

- Potential difficulty in evaluating impact. Evaluating the impact or ‘additionality’ of blended finance can be challenging due to several factors. For instance, without a control situation to quantity what would occur without the additional finance mobilised, development finance providers often rely on qualitative assessments, which may fall short of investors’ expectations. Furthermore, measuring the social or environmental outcomes of a project presents difficulties. For example, using tools such as baseline-endline surveys or input-output tables, may not yield the most accurate assessment of the utilisation of blended finance and its impact.

Potential Benefits

- Bridging the financing gap. Blended finance serves as a critical tool to bridge the financing gap for cities. This in turns enables them to embark on greener and smarter initiatives, fuelling a city’s transition towards greater sustainability. Moreover, blended finance tends to provide financial support for high-impact projects that would otherwise not attract funding on fully commercial terms.

- Reduce dependency on public funds. Blended finance can reduce a city’s reliance on public funds for urban development. Through a variety of concessional instruments, blended finance helps rebalance a project’s risk-return profile, leveraging public funds to crowd-in private capital. Donor funds and subsidies can be strategically disbursed to overcome multiple investment barriers, enhance accountability, streamline project delivery, and optimise the use of commercial capital to minimise costs for the public.

- Foster market development. Blended finance projects are strategically designed to address market failures. A well-structured blended finance initiative should be accompanied by policy reforms or capacity building interventions that actively foster market development, with the goal of increasing investment from the private sector and enhancing the commercial sustainability of the project as a whole.

Sources/Additional Information

- Convergence (n.a.). Blended finance definition. Available at: https://www.convergence.finance/blended-finance

- IFC (2023). How blended finance works. Available at: https://www.ifc.org/en/what-we-do/sector-expertise/blended-finance/how-blended-finance-works

- OECD (2020). OECD DAC Blended Finance Principles 2. Design blended finance to increase the mobilization of commercial finance. Available at: https://www.oecd.org/en/about/programmes/clean-energy-finance-and-investment-mobilisation/country-comparison-and-cross-cutting-analysis.html

- OECD (2018). The next step in blended finance. Addressing the evidence gap in development performance and results. Available at: https://www.oecd.org/dac/financing-sustainable-development/development-finance-topics/OECD-Blended%20Finance-Evidence-Gap-report.pdf

- World Bank (2019). Innovative finance solutions for climate-smart infrastructure – New perspectives on results-based blended finance for cities. Available at: https://documents1.worldbank.org/curated/en/917181563805476705/pdf/Innovative-Finance-Solutions-for-Climate-Smart-Infrastructure-New-Perspectives-on-Results-Based-Blended-Finance-for-Cities.pdf