Case Studies

The case studies below represent a curated collection of examples that illustrate the strategic use of innovative financing instruments to fund and drive the transformation of smarter and more sustainable cities.

- [rt_reading_time label="" postfix="min read" postfix_singular="min read"]

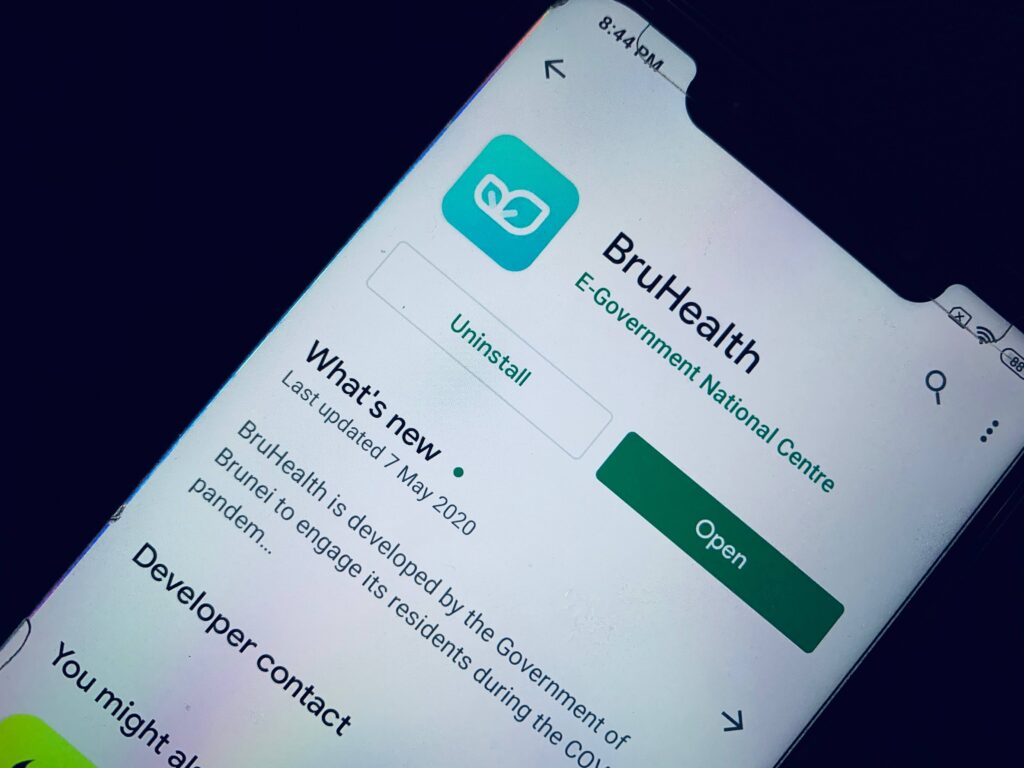

The Brunei Darussalem government allotted B$18 million (USD 13.4 million)* for the development of BruHealth phase II and III in its budget for FY23/24.

- [rt_reading_time label="" postfix="min read" postfix_singular="min read"]

Building a solar power plant was facilitated by blended concessional finance, with a US$41 million total cost with support of US$4 million from the Canada-IFC Blended Finance Program.

- [rt_reading_time label="" postfix="min read" postfix_singular="min read"]

The Toll Road Special Vehicle (BUJT) operating the MBZ Toll Road has divested 40% of its share in PT Jasamarga Jalanlayang Cikampek (JJC) worth IDR 4.38 trillion (USD 291.6 million) * to PT Margautama Nusantara (MUN) which is a subsidiary of Salim Group Company.

- [rt_reading_time label="" postfix="min read" postfix_singular="min read"]

US$ 45 million through regional development funds

- [rt_reading_time label="" postfix="min read" postfix_singular="min read"]

Malaysia stands as one of the world’s major hubs for Islamic banking, boasting a well-established sukuk market that represents approximately 40% of global outstanding sukuk as of 3Q2023. In 2014, the country introduced its Sustainable and Responsible Investment (SRI) sukuk framework to position itself as a centre for green and sustainable Islamic finance.

- [rt_reading_time label="" postfix="min read" postfix_singular="min read"]

The Government of Japan through the Japan International Cooperation Agency (JICA) supported an UN-Habitat project with the Yangon authorities to improve sanitation and waste management services in Yangon through a technical assistance grant of US$7.27 million. The project was planned to benefit approximately 25,000 households and over 250 schools.

Brunei Darussalam

Brunei Darussalam Cambodia

Cambodia Indonesia

Indonesia Lao PDR

Lao PDR Malaysia

Malaysia Myanmar

Myanmar Philippines

Philippines Singapore

Singapore Viet Nam

Viet Nam Chile

Chile India

India Netherlands

Netherlands Sweden

Sweden Thailand

Thailand U.S.A

U.S.A